Ready to create more pipeline?

Get a demo and discover why thousands of SDR and Sales teams trust LeadIQ to help them build pipeline confidently.

By conducting a go-to-market analysis, organizations can learn more about their customers, how to target them, and how much they’re willing to pay.

A solid go-to-market analysis enables organizations to identify target markets, sales strategies, marketing channels, product positioning, and brings teams together.

Once your analysis is finished, you can then create a data-driven go-to-market strategy that helps you achieve your business goals.

Get a demo and discover why thousands of SDR and Sales teams trust LeadIQ to help them build pipeline confidently.

Revenue teams today face increased pressure to stand out in crowded markets, align their strategies, and drive revenue growth amidst constant change. Misaligned priorities, inefficient resource allocation, and a lack of data-driven insights often prevent them from achieving their full potential.

Whether you’re already in market but struggling, launching a new product, or are a brand new startup, by conducting a thorough go-to-market analysis, organizations can address these challenges by uncovering key market opportunities, refining targeting strategies, and enabling smarter, more cohesive decisions that lead to sustainable revenue growth.

A go-to-market (GTM) strategy is a comprehensive plan that outlines how a company will introduce its products and services to a target market, engage its audience, and ultimately drive revenue. Far from being just a buzzword, a GTM strategy is a critical framework for aligning sales, marketing, customer success, and product teams around shared goals and ensuring they successfully enter or expand into a market.

While organizations need to understand what a go-to-market strategy is in order to achieve the best business outcomes, it’s equally important to understand what a go-to-market strategy isn’t.

A GTM strategy isn’t a generic marketing plan or a one-size fits all approach to launching products. Instead, it’s a bespoke, data-driven roadmap that considers your target audience, competitive landscape, and specific value propositions that unify what customers want and what your product solves.

Ultimately, a solid GTM strategy helps you navigate the complexities of reaching your ideal customers in the most effective way possible.

Before diving into the strategy itself, however, it’s important to perform a thorough market assessment, which is often called a go-to-market analysis. This step involves evaluating market demand, identifying key customer segments, analyzing competitors, and assessing the best channels for distribution.

Simply put, a well-executed analysis creates a solid foundation for your GTM strategy, helping you uncover critical insights while enabling you to make smarter, more informed decisions.

Whether you’re a brand-new startup or an established enterprise, a go-to-market analysis is essential when launching a new product or entering a new niche. That said, these aren’t the only scenarios where conducting a GTM analysis can provide value.

With that in mind, let’s explore some key moments where your organization would be best off performing a GTM analysis before figuring out what your next moves are:

Now that you have a better idea of when to conduct a go-to-market analysis, let’s turn our attention to the specific steps you can take to get through the process.

Before you begin crafting your GTM strategy — which includes defining your ideal customer profile (ICP), deciding which channels to use, and figuring out whether you’re going to take a product-led GTM approach or something else — you need to do your research.

If you jump straight into creating a GTM strategy without doing the foundational work, it’s a lot like taking a test on a subject you never studied. 😱

To avoid that fate, let’s discuss how your team can start analyzing potential GTM options through a complete market assessment and analysis.

When conducting a go-to-market analysis, one of the first steps is to review what already exists in the market.

For new companies introducing a product, it’s crucial to understand what has been tried — and what has failed — and how the problem you’re solving is currently being addressed.

While your product or service might feel transformative, the reality is that most problems already have existing solutions; you might just be building a better mousetrap. If no one is addressing the issue, however, it’s worth considering whether the problem is significant enough for customers to care about solving in the first place.

If you’re launching a project management platform, for example, look at existing solutions like Trello, Asana, and Monday.com. Identify their limitations and figure out what you can do to offer a better, more robust alternative. A good way to do this is to look at G2 for 2-4 star reviews and understand the main complaints. Reddit can also be a helpful place to look at what folks are really saying about a product or service.

For existing companies expanding into new markets or launching new products, this step is equally important. Examine how your current customers solve similar problems or how companies in the target market — those with comparable funding, size, or revenue — are addressing the issue. This will help you identify gaps and opportunities in the market.

By the end of this step, you should have:

Altogether, this data is foundational when it comes to crafting a strategy that positions your organization for success.

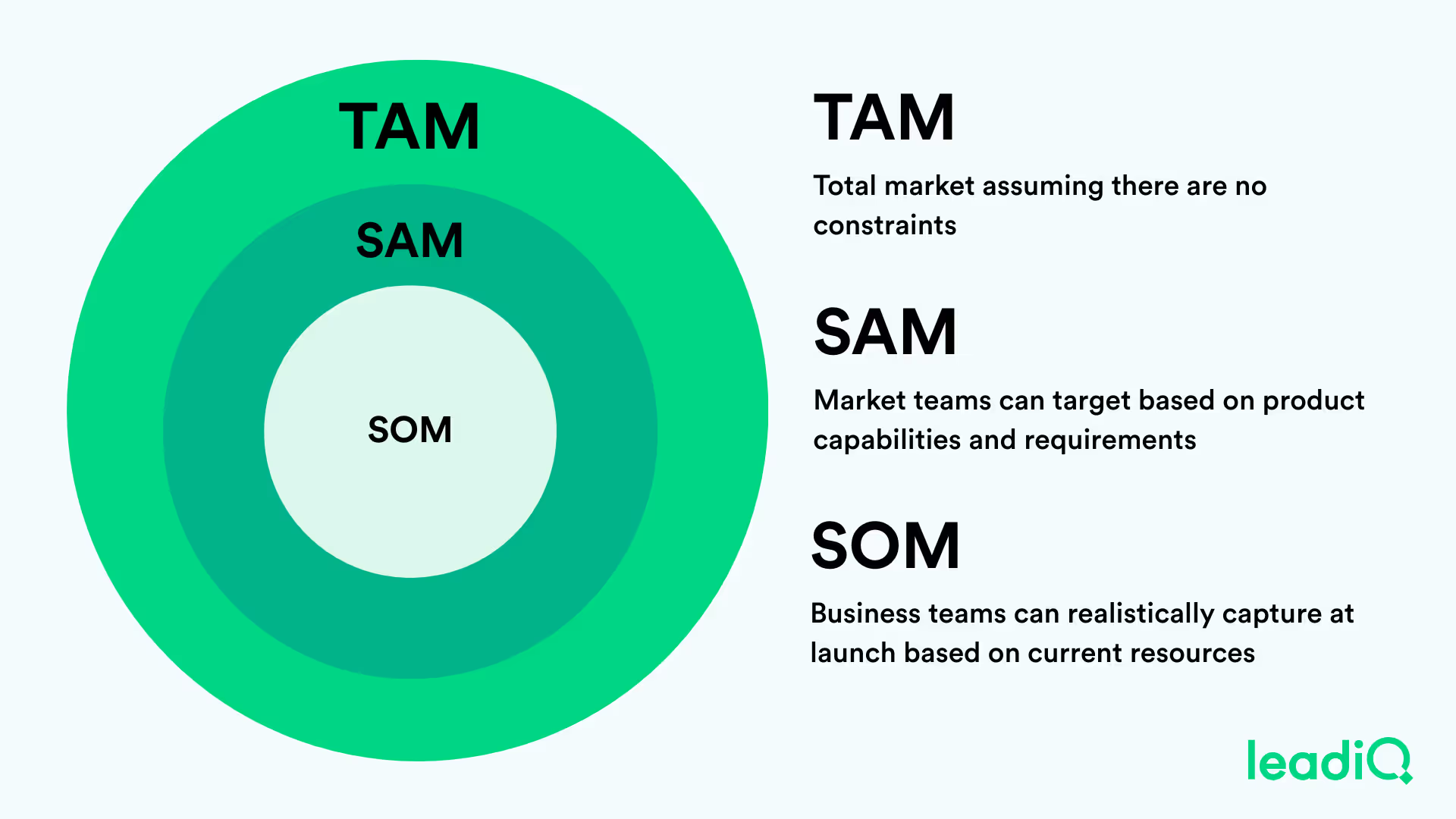

Now that you have a baseline of what’s already out there and the overall size of the market you’re targeting, it’s time to focus on the organizations you think you can help today. The easiest way to do this is by defining these three groups:

While CEOs often sell the dream of the TAM, your GTM efforts should really zero in on your SOM. After all, this is the narrow segment of customers that will actually buy your product.

For example, if you sell AI sales technology that helps automate tasks, your TAM could technically include every single B2B company. However, your SOM might be much smaller — maybe only companies that use a specific platform like Salesforce, don’t require SOC2 compliance, and rely on cold emails to generate leads.

To refine this focus, bring together your product, marketing, and sales teams to discuss who would benefit most from your solution on day one of its launch.

This collaborative effort ensures alignment, helps “kill your darlings” — i.e., eliminates overly broad or unrealistic targets — and sharpens the understanding of the specific problems your product solves today. Product teams can ground sales and marketing’s idealistic visions with practical limitations while executives provide a long-term perspective on market expansion — helping you strike the perfect balance of what’s possible.

During this step, you might identify two or three ICPs if you genuinely believe you can serve them all effectively. Even so, it’s best to focus on just one to start.

Often, an ICP is centered around a specific industry (e.g., construction or farming) or role (e.g., content marketing or finance), with details added from there. Despite your temptations, you don’t want to swing for the fences out of the gate; you might strike out. Narrow your focus and remember that you can always expand it later.

After you complete this step, you should have:

Need more help on defining your ICP? Read this.

At this point, you’ve already identified what’s out in the market and clarified who you’re targeting.

Next, it’s time to focus on how to properly position your product. This step is where marketing takes the lead, since product positioning combines visual and verbal branding guidelines to shape how the market will perceive your product.

Keep in mind that this is a GTM analysis — not the final strategy you’ll use. Your goal here isn’t to create the exact marketing campaign you’ll end up running. It’s to analyze what competitors are doing and — more importantly — how your target customers talk about themselves and their needs.

For example, if you’re selling to construction businesses, the industry’s tone and style are often serious and straightforward, with little patience for fluffy or overly casual marketing. That being the case, using bright colors, Gen Z slang, and trendy language would likely alienate this audience, thwarting your efforts.

For the best results, your positioning should reflect your ICP’s values — like reliability, efficiency, and professionalism — aligning with how they present themselves.

By the end of this step, you should have:

All of this foundational go-to-market analysis sets the stage for building a winning strategy that will help you meet your business objectives.

By now, you’re thinking all of this sounds great. But how do you plan to actually sell your solution? Are you going to encourage prospects to take a self-service approach? Or will you require the prospect to engage with your sales teams? How much will you charge? Will you charge per-seat or will you use usage-based pricing?

Only your team can answer these questions.

Depending on the size and stage of your organization, these decisions might be made by the higher-ups or they could be made as a collaborative effort between executives, product, marketing, and sales teams.

Kick off the process by looking at how your competitors are selling today while being cognizant of the fact that their pricing doesn’t necessarily correlate to business success. While you’re at it, look at how your list of top customers are selling and how they’re used to buying.

For example, more traditional or legacy markets or companies may be used to having to talk to someone on the phone to the point they’ve grown to expect it. Newer companies or newer niches — like AI tech or engineers — may be used to signing up for free and never having to speak to someone before making a large purchase.

Ultimately, this decision is all about finding the balance of how your customers like to buy while ensuring you have the product and team capabilities to meet those expectations.

If your customers are used to having a sales team to talk with but you don’t have the budget to hire a bunch of account executives, you may need to find a middle ground. Additionally, you might think that having a freemium offer is going to eliminate the need for a sales team while your product team might point out that it’ll take a ton of time to build out the necessary payment flows, onboarding processes, and upgrade mechanisms.

And that gets us to pricing: Once you know how you plan to sell, you need to figure out how much you’re going to charge.

If you plan to go the self-service/product-led growth or freemium route, you’ll need to figure out your free offer — is there a totally free tier or a free trial of the complete product? You’ll also need to figure out:

All of this information will likely be published right on your website. To make a favorable impression, it all needs to be locked in and crystal clear! Even if you don’t publish your prices, because it’s based on a variety of factors that have to be discussed, you should be as clear as possible internally about your pricing strategy.

If you plan to go more of a sales-led route, you’ll still need to think about these things, just in a different way. You’ll have a sales team that is prospecting, demoing, and closing deals with potential customers. Your pricing might not be so public, and you’ll likely sell a more complex or expensive solution.

Should you decide to go this route, you’ll still need to define:

Of course, you’ll also need to ensure you have all the necessary paperwork and documentation drafted before you go to market.

Once you wrap this step, you should have these details ironed out:

Now that you understand what your competitors are doing, know what your ICP looks like, have put together a potential product positioning strategy, and have locked in your pricing and packaging, it’s time to think about how to get the word out about your new product.

For product-led growth, companies often rely on automated channels — like ads or SEO. The goal is to figure out how customers can naturally come across your brand in their daily lives. These channels are typically owned by marketing because there often isn’t a dedicated sales team in the mix.

For sales-led growth, distribution focuses on more personalized approaches — like cold calling, cold emailing, LinkedIn social selling, brand-building partnerships, webinars, and other strategies that put a “face” to the brand. Here, the emphasis is on building trust and personal connections with potential customers.

That said, the lines can blur. Product-led teams might also build brand awareness through podcasts or newsletters while sales-led teams may invest in retargeting ads for prospects they’ve already engaged with.

No company has unlimited resources. That being the case, it’s critical to assess competitors’ strategies and consider your own time, budget, and team capacity. For example, if you have a $100,000 marketing budget, how should you spend those funds and what are the potential outcomes you might experience?

Luckily, you don’t have to complete this exercise entirely on your own. There are tons of tools on the market that can help predict outcomes — like estimating results from podcast sponsorships along with costs, advertising ROI, and even setting quotas for cold emailing.

Once you’ve wrapped this step up, here’s what you should have:

Now that you’ve done the foundational work of a go-to-market analysis, it’s time to start creating your own GTM strategy! You know what’s out there and what your potential customers like; all that’s left to do is put together a unique strategy based on all the information you’ve collected.

We’ll talk more about GTM in future posts. In the meantime, here are some resources you might want to check out:

Pssst: As you take the step of launching your GTM strategy, you’ll likely need a good contact database and a robust data enrichment tool to help accelerate your efforts and make sure your hard work pays off.

Ready to see why today’s leading GTM teams trust LeadIQ for contact data (and a whole lot more!)? Request a demo today.